info o cardingu:

•SHOPPING FROM A LOCATION WHERE YOU NEVER SHOPPED BEFORE.

A buyer quoted “I’ve had calls from my card company saying, we’ve detected some unusual activity. It wasn’t unusual, but it was a different pharmacy than the one I normally go to”. This is why it is extremely important to get an RDP as close as possible to the CVV holder’s address or previous RECENT addresses as possible. And obviously, the RDP needs to be non-blacklisted, with clean risk and proxy scores.

• MAKING SEVERAL PURCHASES QUICKLY.

One example is a buyer that sometimes hits three grocery stores in a row to find what she needs and take advantage of sales. But a few months ago, was so speedy that by the time she swiped her card at the third store, it was declined. She quoted “I called the bank when I got home, and they told me that shopping at three supermarkets within an hour or so was considered ‘unusual activity’.

• CHARGING SOMETHING SMALL, THEN SOMETHING BIG.

This is very commons as fraudsters like to sort of test the waters with a stolen card by first charging a tiny amount, say a song on iTunes or even using a charged CVV checker (never use such checkers), before moving on to a big purchase. That small to big pattern in the CVV holder’s buying patterns can potentially lead to a declined/blocked card.

•SHOPPING AWAY FROM YOUR HOME.

This is very common when someone moves from one place to another. A fraud expert quoted “If my billing address is Massachusetts and I’m buying a washer and dryer in Idaho, that is an anomaly, because why would I buy a washer and dryer in Idaho if I live in Massachusetts?”. Another reason why RDPs are so important.

•CHARGING TRAVEL EXPENSES.

On the road, any purchase from gas to restaurant meals can trigger a block. While that’s long been true for travelers abroad, it now happens domestically too. A buyer quoted “Once my travel to L.A. was flagged and I spent 20 minutes verifying transactions”. When she asked what caused the card to be declined, she was told “a taxi, a charge at the airport, in-air Wi-Fi and a rental car hold” – all standard travel expenses.

•YOU HAVE REACHED THE CVV’S CREDIT LIMIT.

This is pretty much self- explanatory and I shouldn’t have to go into details.

•BUYING THINGS IN DIFFERENT GEOGRAPHIC LOCATIONS ON THE SAME DAY.

During a cruise, one buyer, used a card to get money from an ATM on the ship, then she later made a purchase on-shore in Belize. For the rest of the trip, her card was declined”. Apparently, the ATM on board the ship is registered to a Miami location, and several hours later, she was purchasing something in Belize. To the bank, it looked very suspicious because the transactions happened so close together. Online purchases to merchants in different parts of the world can trigger the same flag.

INFO o socksach itp.

Use socks5 ( dont use socks4 or http proxies as they might leak DNS info) which match the cardholder's billing address.

If your CC is from UK, try to use a UK drop and so on for other countries

If the gift option is there, put it so it looks like you are shipping a gift to some friend, girlfriend etc.

Try to make orders before holidays like valentines etc. Now this is an old trick but it works for 2 reasons. The shops get many orders these days, so they can pass your fraud one as legitimate too. And it looks like you are sending a legit gift

For your security, use cracked/open wifi + changed MAC, VPN in some offshore country + 2-3 socks in a virtual machine. I suggest VMWare and do download a ready made image so just open it. Try to create a proxy chain for your own security, with the last external IP being the one to match cardholders address.

Use Firefox in private mode with extensions. Find some security related extensions which dont track your links, clear cookies, LSO & flash cookies, etc. Be creative and explore.

Dont use gmail/hotmail/yahoo when ordering ! Use @some hipster email provider, one which is not really used by a lot of people. It makes it look legit. ISP emails are preferred but you might not be able to create them if you are reading this article

If your card holder is Billy Nye, use email which is similar to his name.

Have a ready VoIP account and call the shop if they have to confirm information. Usually they only ask about CC info and shipping adress. You dont want to call them with a man voice when CC is a female's, do you ? Use voice changers instead. Do this even when confirming orders for man CCs, to mask your identity.

Checking CCs before making purchase is highly discouraged as most checkers flag/kill cc. Try this on your own risk.

Check BIN before trying order. If it is credit platinum, chances are you can buy a fuckton of things. If its debit classic, good luck with that.

There are some services that offer DOB and SSN checks. You might want to use them if you dont have fullz.

What is Carding?

•SHOPPING FROM A LOCATION WHERE YOU NEVER SHOPPED BEFORE.

A buyer quoted “I’ve had calls from my card company saying, we’ve detected some unusual activity. It wasn’t unusual, but it was a different pharmacy than the one I normally go to”. This is why it is extremely important to get an RDP as close as possible to the CVV holder’s address or previous RECENT addresses as possible. And obviously, the RDP needs to be non-blacklisted, with clean risk and proxy scores.

• MAKING SEVERAL PURCHASES QUICKLY.

One example is a buyer that sometimes hits three grocery stores in a row to find what she needs and take advantage of sales. But a few months ago, was so speedy that by the time she swiped her card at the third store, it was declined. She quoted “I called the bank when I got home, and they told me that shopping at three supermarkets within an hour or so was considered ‘unusual activity’.

• CHARGING SOMETHING SMALL, THEN SOMETHING BIG.

This is very commons as fraudsters like to sort of test the waters with a stolen card by first charging a tiny amount, say a song on iTunes or even using a charged CVV checker (never use such checkers), before moving on to a big purchase. That small to big pattern in the CVV holder’s buying patterns can potentially lead to a declined/blocked card.

•SHOPPING AWAY FROM YOUR HOME.

This is very common when someone moves from one place to another. A fraud expert quoted “If my billing address is Massachusetts and I’m buying a washer and dryer in Idaho, that is an anomaly, because why would I buy a washer and dryer in Idaho if I live in Massachusetts?”. Another reason why RDPs are so important.

•CHARGING TRAVEL EXPENSES.

On the road, any purchase from gas to restaurant meals can trigger a block. While that’s long been true for travelers abroad, it now happens domestically too. A buyer quoted “Once my travel to L.A. was flagged and I spent 20 minutes verifying transactions”. When she asked what caused the card to be declined, she was told “a taxi, a charge at the airport, in-air Wi-Fi and a rental car hold” – all standard travel expenses.

•YOU HAVE REACHED THE CVV’S CREDIT LIMIT.

This is pretty much self- explanatory and I shouldn’t have to go into details.

•BUYING THINGS IN DIFFERENT GEOGRAPHIC LOCATIONS ON THE SAME DAY.

During a cruise, one buyer, used a card to get money from an ATM on the ship, then she later made a purchase on-shore in Belize. For the rest of the trip, her card was declined”. Apparently, the ATM on board the ship is registered to a Miami location, and several hours later, she was purchasing something in Belize. To the bank, it looked very suspicious because the transactions happened so close together. Online purchases to merchants in different parts of the world can trigger the same flag.

INFO o socksach itp.

Use socks5 ( dont use socks4 or http proxies as they might leak DNS info) which match the cardholder's billing address.

If your CC is from UK, try to use a UK drop and so on for other countries

If the gift option is there, put it so it looks like you are shipping a gift to some friend, girlfriend etc.

Try to make orders before holidays like valentines etc. Now this is an old trick but it works for 2 reasons. The shops get many orders these days, so they can pass your fraud one as legitimate too. And it looks like you are sending a legit gift

For your security, use cracked/open wifi + changed MAC, VPN in some offshore country + 2-3 socks in a virtual machine. I suggest VMWare and do download a ready made image so just open it. Try to create a proxy chain for your own security, with the last external IP being the one to match cardholders address.

Use Firefox in private mode with extensions. Find some security related extensions which dont track your links, clear cookies, LSO & flash cookies, etc. Be creative and explore.

Dont use gmail/hotmail/yahoo when ordering ! Use @some hipster email provider, one which is not really used by a lot of people. It makes it look legit. ISP emails are preferred but you might not be able to create them if you are reading this article

If your card holder is Billy Nye, use email which is similar to his name.

Have a ready VoIP account and call the shop if they have to confirm information. Usually they only ask about CC info and shipping adress. You dont want to call them with a man voice when CC is a female's, do you ? Use voice changers instead. Do this even when confirming orders for man CCs, to mask your identity.

Checking CCs before making purchase is highly discouraged as most checkers flag/kill cc. Try this on your own risk.

Check BIN before trying order. If it is credit platinum, chances are you can buy a fuckton of things. If its debit classic, good luck with that.

There are some services that offer DOB and SSN checks. You might want to use them if you dont have fullz.

What is Carding?

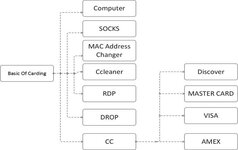

- Carding itself is defined as the illegal use of the card (Credit/Debit) by unauthorized people (carder) to buy a product. For educational purposes, I will now show how a carder is able to go about their illicit activities. Remember – carding is highly illegal, and should not be attempted under any circumstances.

- Let us understand each point one by one

2.4 CCleanerIt is very useful tool help in cleaning your browsing history, cookies, temp files, etc.Many people ignore this part and get caught, so be careful and don’t forget to use it J

2.5 RDP (Remote Desktop Protocol)RDP allows one computer to connect to another computer within the network. It is protocol developed by Microsoft.Basically, carders use it to connect to computers of the geolocation of the person whose credit card carder want to use. It is used for safety and stay anon. Here carders use others PC for doing carding instead of their own.

2.6 DROPDROP is an address which the carder uses for the shipping address in the carding process.Let me explain in details with an example:If I am carding with US credit card, then I use USA address as shipping address then my order will be shipped successfully, and I will be safe. If you have relatives/friends, then no problem, otherwise use sites who provide drop services only we have to pay extra for shipping it.

2.7 Credit cardThis part is very much important so read it carefully. Any credit card it is in the following format:| credit card Number |Exp Date| CVV2 code | Name on the Card | Address | City | State | Country | Zip code | Phone # (sometimes not included depending on where you get your credit card from)|e.g.: (randomly taken number/details)| 4305873969346315 | 05 | 2018 | 591 | UNITED STATES | John Mechanic | 201Stone Wayne Lane | Easternton | MA | 01949 |

Types of credit cardEvery Credit card company starts their credit card number with a unique number to identify individually like shown below

American Express (AMEX Card) – 3

Visa Card – 4

Master Card – 5

Discover (Disco) – 6

Company wise credit card details

VisaClassic: The Card is used worldwide in any locations designated by Visa, including ATMs, real and virtual Stores, and shops offering goods and services by mail and telephone.

Gold – This card has a higher limit capacity. Most used card and adopted worldwide.

Platinum – Card is having limits over $10,000.Signature – No preset spending limit – great bin to get

Infinite – Most prestigious card with having virtually no limit. There is less in circulation so be alert when buying these. Use only with reputable sellers!

Business – it can be used for small to medium sized businesses, usually has a limit.

Corporate – it can be used with medium to large size businesses, having more limit than a Business card.

Black – It has limited membership. It has no limit only having $500 annual fee, high-end card.

MasterCardStandard – it is same as classic visa card.

Gold – it is same as visa gold card.Platinum – it is same as visa platinum card

World – it has a very high limit.

World Elite – it is virtually no limit, high-end card.

Amex CardGold – it usually has around a 10k limit.

Platinum- is usually has a higher limit (around 35k).Centurion – it has a High limit (75k+). It is also known as the black card, note: do not confuse with visa black card.

- Let us understand each point one by one